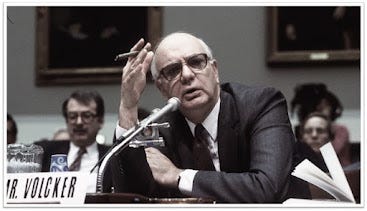

Book review: Paul Volcker

Keeping at It: The Quest for Sound Money and Good Government

Author: Paul A. Volcker (with Christina Harper)

I was always curious to know more about Paul Volcker, the economic Tzar who finally put inflation under control in the 1980s after deicides of instability, ushering the new era of “Great Moderation”. This was a man at the forefront of many critical junctures of the USA’s recent history: breakdown of Bretton Woods in 1971, desperate diplomatic attempts to stabilise the international monetary system in the 1970s, the shift towards monetarism by Jimmy Carter, the Reagan revolution of the 1980s and finally, the financial regulations introduced in the aftermath of 2008 financial crisis (Dodd-Frank reforms). To me, his career trajectory embodies the revolving door between Wall Street, the Fed and the Government:

-New York Fed

-Chase Manhattan Bank

-US Treasury Department

-Governor of the Federal Reserve-Princeton University

- Wolfensohn & Co (New York investment bank).

The main shortcoming of the book is that it’s been written by the hero of the story himself rather than a professional historian. So, like most autobiographies written by policymakers, it lacks critical distance and offers no comparative perspective. But the book has its strengths mainly the insider view it provides to some important historical episodes. I particularly enjoyed his account of: -Breakdown of Bretton Woods in 1971. (Ch.5)-Quarrels within the Nixon administration about controlling inflation (Ch.5)-President Carter backing the Fed’s hawkish monetary policy (Ch.8)-The changing structure of the banking sector in 80s and the jump in velocity of money (Ch.8)-The Latin American debt crisis of 1983 (Ch.9) I wished Volcker said a little bit more about his intellectual development throughout these years, specifically on how his views evolved around monetarism and inflation targeting. Anyhow, I would recommend the book only if you are into macroeconomic history and interested in the autobiography genre in general. I would give it 5 out of 10.

Related readings/videos/podcasts:

What Paul Volcker taught us about taming inflation, Financial Times (3:20 min).

Former Fed Chairman Paul Volcker dies at age 92, CNBC (1:49 min)

Listen to part 1 of the book (12:14 min).

"America's Peacetime Inflation: The 1970s" by J. Bradford De Long in Reducing Inflation: Motivation and Strategy, eds. Christina D. Romer and David H. Romer (U. Chicago; 1997)